How Small Investments Today Become Your Financial Fortress Tomorrow

The Hidden Power of €50 a Month

In a world where financial security feels like a luxury reserved for the wealthy, here's the uncomfortable truth: your generation might be the first in modern history to face retirement without reliable pensions, affordable healthcare, or accessible credit.

The safety nets previous generations took for granted are crumbling — and no one's coming to save you. 🚨

The statistics paint a sobering picture: public pension systems across Europe are strained beyond capacity, healthcare costs are skyrocketing while public services deteriorate, and traditional job security is becoming a relic of the past.

Meanwhile, inflation quietly erodes your purchasing power while wages stagnate. The social contract that promised "work hard, retire comfortably" has been broken. 💔

But here's what they don't tell you: this crisis is also your greatest opportunity.

While others wait for governments to fix unfixable systems, you can build your own financial fortress.

While others depend on promises that won't be kept, you can create the security that institutions used to provide.

The question isn't whether you can afford to invest.

The question is whether you can afford not to. ⚡r

👋 Hey everyone! Umbi here.

Today I want to share a story that might change how you think about money forever.

It's about two friends, similar backgrounds, similar dreams — but one simple decision that created a massive difference in their financial efficiency. 💰✨

Let me introduce you to Giulia and Marco.

This isn't just another finance story — it's about the hidden power that most young people completely ignore while their financial future slips away. ⚡

The Tale of Two Futures: When €50 Beats €150

🎓 Meet Giulia: 20 years old, fresh graduate, entry-level salary in Milan.

Between rent, groceries, and the occasional aperitivo with friends, money feels tight.

But she makes one decision that seems almost insignificant: she invests €50 every month — less than two weekend dinners out. 💡💶

📈 Meet Marco: Giulia's older brother, 35 years old, climbing the corporate ladder with double her salary. He's been saying for years, "I'll start investing when I have more money."

Finally, at 35, he begins with €150 monthly — three times Giulia's amount. ⏳📊The

Shocking result?

By age 60:

Giulia (started at 20 with €50/month): €131,241

Marco (started at 35 with €150/month): €121,510

Wait - now Giulia has MORE money! Here's the real shock: Giulia invested only €24,000 total while Marco invested €45,000 total. Giulia got €131,241 by investing €24,000, while Marco invested €45,000 to get only €121,510. That's almost double the investment for LESS return! 🤯

How is this even possible?

The Science Behind This "Magic": Compound Interest Explained

Einstein allegedly called compound interest "the eighth wonder of the world." Here's why he was right:

Simple Interest: You earn money on your initial investment only. Compound Interest: You earn money on your money... and on the money your money made... and on the money that the money your money made, made. 🌱➡️🌳

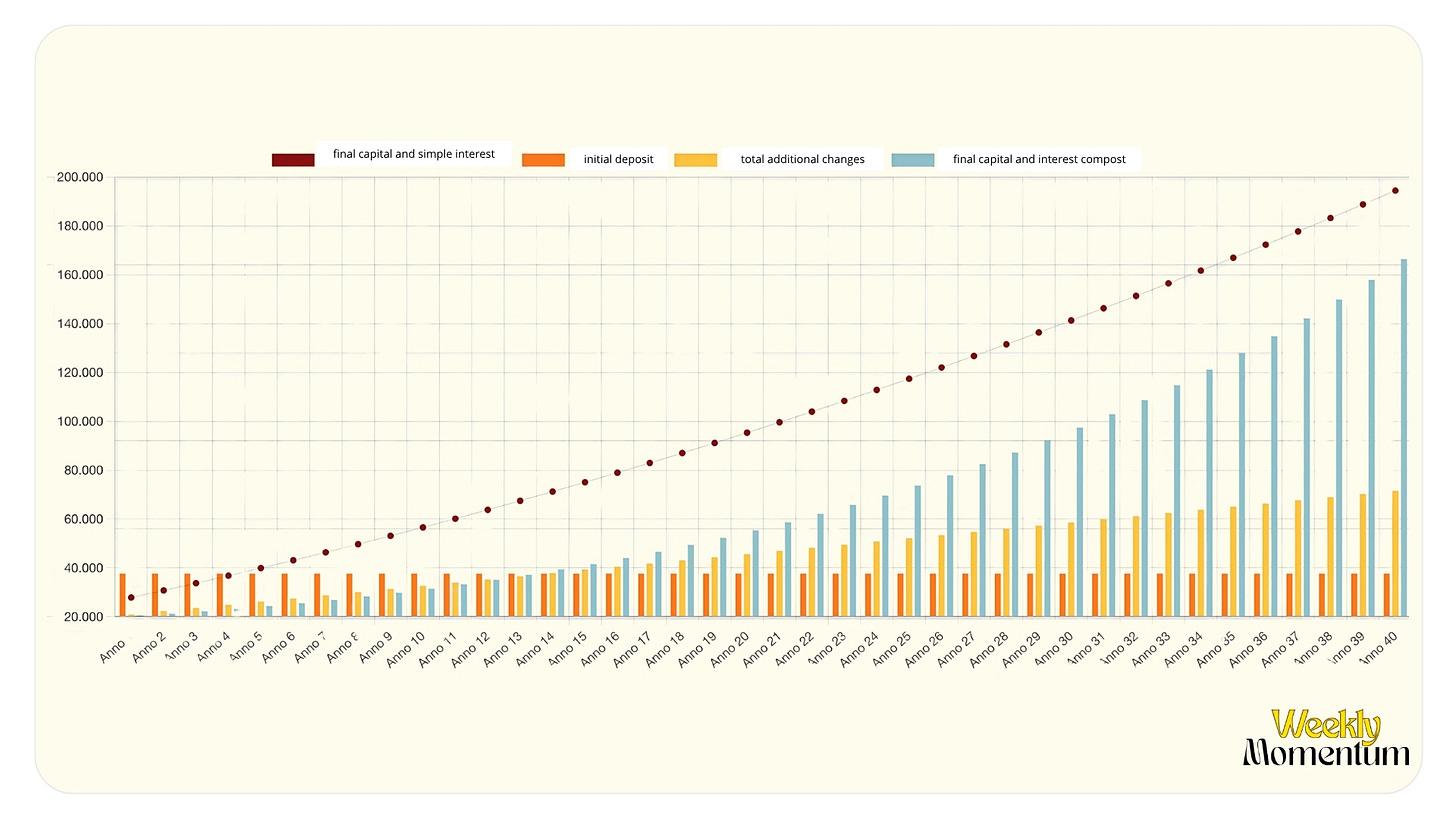

Let's break down Giulia's journey with compound interest at 7.23%:

Total invested over 40 years: €24,000 (€50/month) Final result: €131,241

The dramatic difference:

With simple interest: €24,000 invested + €33,530 interest = €57,530

With compound interest: €24,000 invested + €107,241 interest = €131,241

Notice the acceleration? In the first 10 years, compound interest doesn't look dramatically different from simple interest. But in the last 10 years, the magic happens - your money starts making serious money on the money it already made. Time is literally money multiplying itself.

With compound interest, Giulia earns €73,711 more than she would with simple interest. That's the power of letting time work for you.

"I Don't Have Enough Money" - The Lies We Tell Ourselves

Let's do a brutal honesty check. How much do you spend monthly on:

☕ Coffee shops: €3 × 15 days = €45 🍕 Food delivery: €12 × 4 orders = €48

🎬 Netflix + Spotify + other subscriptions: €25 🍻 Weekend drinks: €30 🛒 Impulse purchases: €35

Total: €183/month on things you won't remember in 6 months.

But €20/month for your future self? "I can't afford it." 🤔

The Reframe That Changes Everything

Instead of thinking "I need to invest €20/month," think:

"I need to pay my future self €20/month."

€20/month = €0.67/day = less than a coffee.

You're not "spending" €20. You're transferring it from your current broke self to your future wealthy self. And your future self will thank you with compound interest. 💝

How to Start Today: The Trade Republic Game Plan

Here's your step-by-step guide to building wealth on autopilot:

Step 1: Choose Your Weapon - Trade Republic 📱

Why Trade Republic is perfect for beginners:

€1 per transaction (not percentage-based)

Clean, simple interface (no overwhelming charts)

Automatic investing plans (set it and forget it)

Free ETF savings plans (no fees for monthly investments)

€10 minimum (you can literally start with less than a pizza)

Step 2: Your First Investment - MSCI World ETF 🌍

Don't overthink this. Start with one ETF: MSCI World.

What you're buying: Pieces of ~1,500 companies worldwide What you own: Apple, Microsoft, Amazon, Google, Samsung, ASML, and 1,495+ others Historical returns: 7-8% annually over 50+ years Diversification: Automatic. You own the world's best companies.

Popular options on Trade Republic:

iShares Core MSCI World (IE00B4L5Y983)

Xtrackers MSCI World (IE00BJ0KDQ92)

For more information we recommend you visit the following site: justETF

Step 3: Automate Everything (The Secret Sauce) 🤖

Set up a "Accumulation Plan" (PAC):

Choose the 5th of every month (after your salary hits)

Start with €15-20/month

Increase by €5 every time you get a raise

Never touch it for 10+ years

The psychology hack: Make it automatic so you never have to "decide" to invest. It just happens, like paying rent.

Step 4: The Graduated Approach 📈

Month 1-3: €15/month (prove to yourself you can do it) Month 4-12: €25/month (as it becomes normal) Year 2+: €50+/month (as your salary grows)

The key: Start small, but START. Perfect is the enemy of good.

The Mistakes That Kill Your Future Wealth

⚠️ Mistake #1: Waiting for the "Perfect" Time "I'll start when the market crashes" or "I'll wait until I understand everything"

Reality: The best time to plant a tree was 20 years ago. The second-best time is now.

⚠️ Mistake #2: Panic Selling During Downturns Markets go up and down. If you sell during a crash, you lock in losses instead of buying more shares cheaply.

The mantra: "Time in the market beats timing the market."

⚠️ Mistake #3: Overcomplicating Everything Buying 10 different ETFs, trying to pick individual stocks, constantly changing strategy.

The truth: Boring investing is profitable investing. MSCI World + time = wealth.

⚠️ Mistake #4: Stopping When You See Red Numbers Your first market crash will test you. Remember: you haven't lost money until you sell.

The mindset shift: Red numbers = discount shopping. You're buying more shares for the same €20.

The Real Cost of Inaction (This Will Hurt)

Every month you delay investing costs you exponentially more than the money you're "saving."

Delay by 1 year: Costs you ~€3,000 at retirement

Delay by 5 years: Costs you ~€15,000 at retirement

Delay by 10 years: Costs you ~€30,000 at retirement

That €20/month you're "saving" today is actually costing you €3,000 next year.

Let that sink in. 💭

The Opportunity Cost Reality Check

While you're debating whether to start:

Inflation is eating your cash savings (2-3% annually)

Your money in a savings account is losing purchasing power

Your friends who started are compounding gains

Time—your most valuable asset—is slipping away

Every day of delay is a day of compound interest you'll never get back.

Your Competitive Advantage: Think in Decades, Not Days

While your peers are:

Spending everything they earn

Keeping money in 0.1% savings accounts

Waiting for "more money" to start investing

Buying liabilities (expensive cars, designer clothes)

You'll be:

Building assets that work 24/7

Leveraging the most powerful force in finance

Creating financial freedom in your 40s, not 60s

Developing wealthy habits early

The compound effect works on habits too. Start investing at 20, and by 23 it's automatic. Start good financial habits at 23, and by 28 you're financially sophisticated. ⚡

The Psychology of Future Self 🧠

Your biggest enemy isn't market crashes or economic downturns—it's present bias. Your current self wants immediate gratification; your future self wants security and freedom.

The trick: Make your future self real. Visualize yourself at 50, 60, 70. What do you want to tell your 20-year-old self?

"Thank you for those small sacrifices. They gave me freedom."

Or:

"Why didn't you start sooner? €20/month would have changed everything."

The Action Plan That Actually Works

This Week:

✅ Download Trade Republic (use a referral code if you have one)

✅ Open your investment account (takes 10 minutes)

✅ Calculate your "coffee money" (track spending for 3 days)

✅ Set up your first €15 investment (just to prove you can do it)

This Month:

✅ Create automatic monthly investment (PAC with MSCI World ETF)

✅ Set calendar reminder to increase amount every 6 months

✅ Tell one friend about compound interest (accountability partner)

✅ Calculate your "freedom number" (25x annual expenses)

This Year:

✅ Never check your investment during market crashes (seriously, don't)

✅ Increase investment with every raise(pay yourself first)

✅ Learn about tax-advantaged accounts (maximize your gains)

✅ Celebrate your first €1,000 invested (you're now an investor!)

The Uncomfortable Truth About Your Financial Future

Here's what nobody tells you: Your financial future is decided in your 20s and 30s, not your 50s and 60s.

The habits you build now, the systems you create today, the small decisions you make monthly — these determine whether you'll have financial stress or financial freedom for the rest of your life. 🔁💸

Most people realize this too late.

They wake up at 40 with no savings, no investments, no plan.

They work until 70 not because they want to, but because they have to. ⏳

But you have a choice right now. ⚡

You can be the person who:

— Complains about being broke while spending €50/weekend on drinks 🍸

— Waits for the "perfect" moment that never comes 🕰️

— Thinks €20/month "doesn't matter" 🙄

— Learns about compound interest at 45 instead of 25 📉

Or you can be the person who:

— Starts today with whatever you have 🚀

— Trusts the process even when it feels slow 🧘

— Values future freedom over present comfort 🔐

— Becomes the example others wish they'd followed 🌟

The Compound Effect Beyond Money

When you start investing young, you don't just build wealth — you build:

Financial Intelligence: Understanding markets, economics, business

Discipline: Delaying gratification, long-term thinking

Goal-Setting Skills: Planning decades ahead, working backward from dreams

Confidence: Knowing you can handle your financial future

Learning Mindset: Constantly educating yourself about money

These skills compound too.

The person who learns to invest at 20 becomes the person who can buy real estate at 28, start a business at 33, and retire early at 48. 💼🏡

The Ripple Effect: Your Financial Decisions Matter

Your choice to start investing today creates ripples that extend far beyond your bank account:

👨👩👧👦 Family Impact: You'll teach your future children about money from experience, not theory

👥 Social Circle: You'll attract friends who think long-term, not just next weekend

💼 Career Decisions: Financial security gives you power to take risks, negotiate salaries, leave toxic jobs

🌍 Community Impact: Financially secure people can be more generous, take on meaningful projects, contribute to causes they care about

Every €20 you invest today is a vote for the kind of person you want to become.

Your Future Self Is Watching

Imagine it's 2064. You're 60 years old. You're sitting in a café, checking your investment account on your phone. ☕📱

Scenario A: You see your investments worth over €130,000 from just €24,000 invested.

You smile, remembering that nervous 20-year-old who almost didn't start investing because "€50 wasn't enough."

You realize the power of starting early and compound interest.

You feel proud, secure, smart. 💰✅

Scenario B: You see €3,000 in your savings account.

You remember all the times you said "I'll start next month" and never did.

You realize you'll probably work until 70.

You feel anxious, behind, trapped. ⏳💸

The difference between these scenarios is the decision you make today.

Not tomorrow.

Not next month.

Not when you have "more money."

Today. ⚡

The Challenge That Changes Everything

Here's my challenge for you:

For the next 90 days, invest €20/month and track one metric: how it feels. 📅💶

Not the returns (they'll be tiny at first).

Not the account balance (it'll seem insignificant).

The feeling of being someone who invests. 🧠

I predict that after 90 days, you'll discover something powerful: you'll feel like an investor.

And people who feel like investors make different decisions than people who feel like spenders. 🔁

They read financial news differently.

They think about purchases differently.

They plan their careers differently.

They see opportunities differently.

The €20 isn't just buying you ETF shares — it's buying you a new identity. 🪪

The Commitment That Counts ✅

Don't just read this and nod along.

Make a commitment right now:

"I commit to investing €____ per month for the next ____ months, starting this week."

✍️ Write it down.

🗣️ Tell someone.

🔒 Make it real.

Because the students who take action today will be the financially free adults of tomorrow. 💡📈

Final Thoughts: The Choice Is Yours

This isn't really about money.

It's about the kind of person you choose to become. 🔁

Do you want to be someone who:

— Takes control of their financial future

— Builds wealth slowly and sustainably

— Makes small sacrifices for big gains

— Trusts the process even when progress feels slow

Or someone who:

— Always wishes they'd started sooner

— Lets financial stress control their life choices

— Spends everything they earn

— Depends on others for security

The €20/month isn't the real investment.

The real investment is in becoming the type of person who prioritizes their future self. 🧠💡

💭 I want to hear from you:

What's your biggest fear about starting to invest?

Have you been making the "not enough money" excuse?

What would financial freedom mean to you personally?

Will you take the 90-day challenge?

Reply to this newsletter with your thoughts—your insights could help fellow students take their first step toward financial freedom!

P.S. If this newsletter made you uncomfortable, good. Growth requires discomfort. If it made you excited, even better. Excitement plus action equals results. ⚡✅

P.P.S. The best time to start invesReply to this newsletter with your thoughts — your insights could help fellow students take their first step toward financial freedom! 💬🚀

P.P.S. The best time to start investing was 10 years ago.The second-best time is today.

Don't let tomorrow's you regret today's inaction.

Until next week—keep your momentum going! 🚀

Umbi

⚠️ Remember: This newsletter is for educational purposes. Always do your own research and consider your personal financial situation before investing. Past performance doesn't guarantee future results, but compound interest is the closest thing to magic in finance. ✨📈